Choosing the best ATM processor can feel like navigating a maze of transactions, client search, etc. With so many options, it’s easy to get overwhelmed. But don’t worry, we’re here to simplify things. From transaction fees to security features, ATM resources, etc., there are crucial factors you need to consider. Think of this guide as your map through the labyrinth, with local references to places in the area you search.

We’ll break down, split, and sample what makes an ATM processor stand out in this area, etc. You’ll learn about key elements, information, etc., that matter most for your business needs. By the end, you’ll have a clear path forward.

Key Takeaways

- Understand Your Needs: Identify your specific requirements and priorities when selecting an ATM processor, including transaction volume, area, and location information.

- Choose Reliable Equipment: Invest in high-quality ATM machines that are compatible with your chosen processor to ensure smooth transactions.

- Ensure Quality Support: Opt for a processor that offers robust customer support, handles sample calls, and provides maintenance services to minimize downtime.

- Check Network Availability: Ensure the processor provides access to a broad banking network, including ATM availability, to offer more convenience to your customers.

- Maximize Earnings: Look for processors that offer competitive interchange rates, surcharge options, ATM transactions, etc., to boost your revenue.

- Evaluate Fees and Contracts: Carefully review all fees, sample contracts, and transaction terms to avoid hidden costs and ensure favorable conditions.

Understanding ATM Processor Selection

Role in Business Model

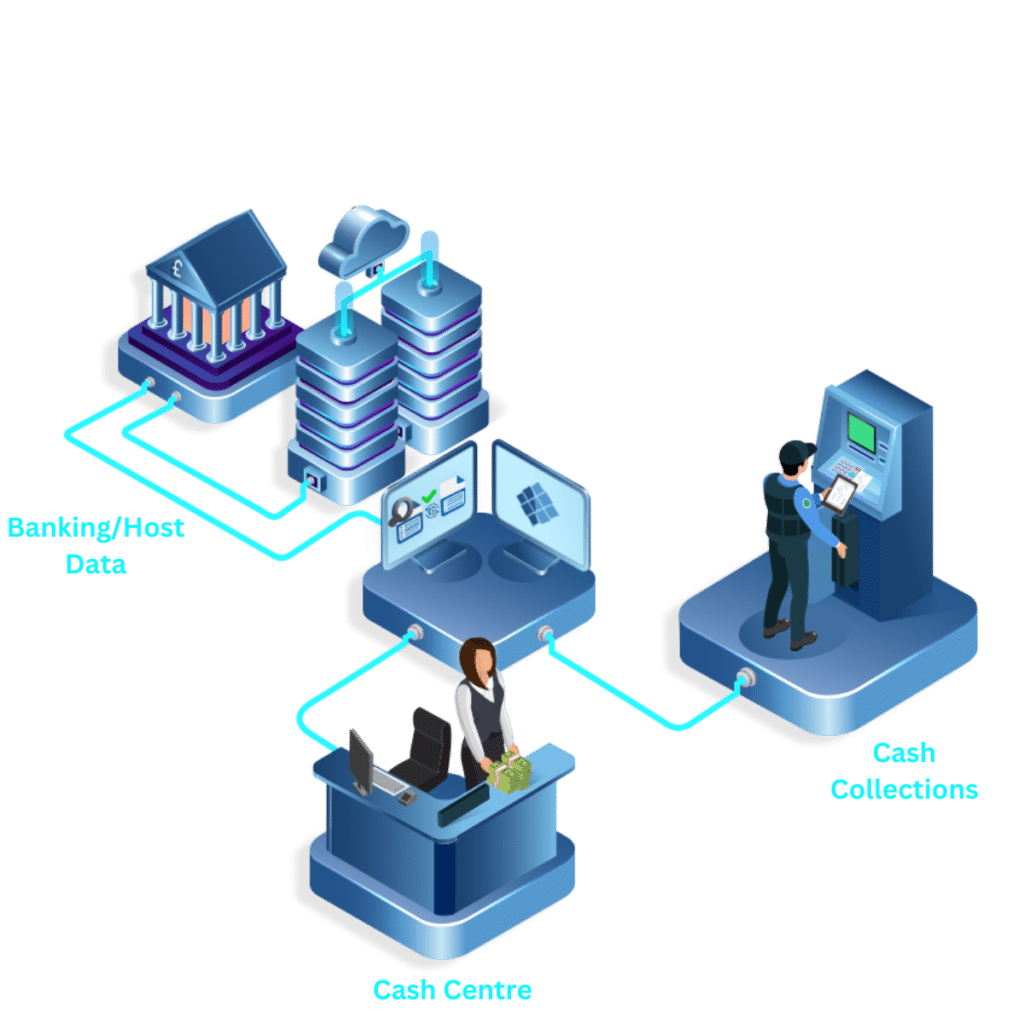

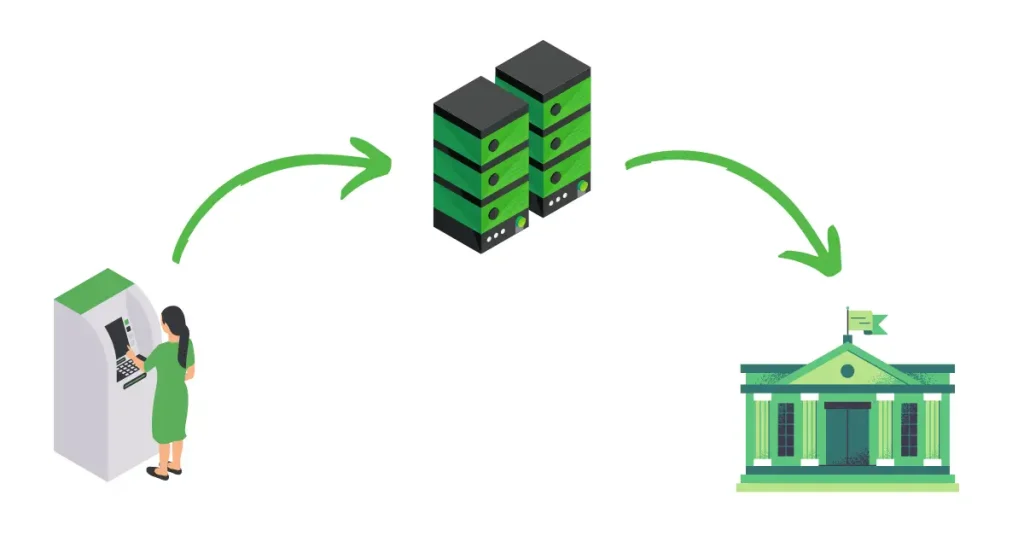

An ATM processor plays a crucial role in your business model, handling transactions, etc., every month in the area. It handles all transactions between the ATM and the bank, etc. This ensures that customers can withdraw cash, check balances, and perform other ATM transactions smoothly, etc.

A good processor improves operational efficiency. It reduces downtime and transaction errors. This leads to higher customer satisfaction and trust in your services, transactions, etc.

Aligning with Business Goals

Choosing an ATM processor that aligns with your business goals and transactions is essential. If your goal is to provide fast and reliable service, you need a processor known for speed and accuracy in handling ATM transactions.

Consider what features are most important for your business. Some processors offer advanced security measures. Others might focus on faster transaction times or better integration with various banks and ATMs.

Meeting Customer Needs

Your customers’ needs and transactions should also guide your choice of an ATM processor. If they value security, choose a processor with strong encryption methods for atm transactions.

If they often travel internationally, select a processor that supports multiple currencies, ATM transactions. Meeting these needs will enhance customer loyalty, atm transactions, and usage rates.

Scalability of Services

As your ATM network grows, so should the capabilities of your processor to handle transactions. A scalable ATM processor can handle increased transaction volumes without compromising transactions performance.

Look for processors that offer flexible service plans. These can adapt as you add more ATMs or expand into new locations and transactions. This ensures continuous support as you grow.

Selecting the Right Equipment

Compatibility Check

Ensure the ATM machine is compatible with the processor. This avoids transaction issues. Look for machines that have been tested with your chosen processor for atm transactions. Compatibility ensures seamless transaction processing.

Verify if the machine supports the necessary software and hardware for atm transactions. Ask the processor for a list of compatible models. This step saves time and resources.

Direct Purchase Benefits

Buying ATM machines directly from the processor has advantages. It often means better integration and support. Processors usually offer installation services too.

Direct purchase transactions can also come with warranties and maintenance plans. These plans reduce downtime and repair costs.

Technological Advancements

Consider technological advancements in ATM equipment. Modern machines like ATMs offer features like touch screens, biometric authentication, and advanced encryption for transactions.

Future-proofing your investment is crucial. Choose equipment that can be upgraded easily as technology evolves, such as ATM machines for transactions.

Location Types

Different locations need different types of ATMs. High-traffic areas might need robust, high-capacity machines. Smaller venues may require compact models.

Evaluate where you will place your ATM machines. Match the machine type to its intended environment for optimal ATM transactions performance.

Ensuring Quality Support

24/7 Availability

Choose ATM processors that offer 24/7 support. This ensures problems are fixed quickly. Minimizing downtime is crucial for businesses. If an ATM goes down at night, having access to help can save a lot of trouble.

Many customers expect ATMs to be available at all times. When the machine isn’t working, they might go elsewhere. This means lost business and unhappy customers.

Installation Assistance

Look for processors providing comprehensive installation and setup support. They should include on-site technician assistance. Installing an ATM can be complex. Having expert help simplifies this process.

Technicians ensure everything works correctly from the start. They also provide training for store staff if needed. This way, everyone knows how to handle basic issues.

Customer Service Track Record

Assess the processor’s track record in customer service and technical support responsiveness atm. Check reviews from other stores using their services. Look for local references who have experience with them.

A good processor will have positive feedback from other businesses. They will respond quickly to any issues that arise.

Information Accessibility

Ensure the processor provides clear information on their services, fees, and ATM. Hidden charges can cause problems later on.

Ask for detailed explanations about all costs involved. Compare this information with other processors to find the best deal atm.

Local Support

Opt for processors with local support teams if possible. Local teams understand regional needs better and can respond faster in emergencies.

They may also have better relationships with nearby stores, offering more tailored solutions and atm services.

Banking Network Availability

Connectivity Range

Ensure the ATM processor connects with many banking networks. This maximizes transaction approval rates. A wide range of connectivity means more customers can use your ATMs. It also reduces the chances of declined transactions.

For example, some processors connect to over 100 networks globally via ATM. This is crucial for areas with high tourist traffic. It ensures foreign cards work seamlessly.

Usability Impact

Network availability affects your ATM’s usability. If the network is down, customers can’t access their money at the ATM. This leads to frustration and dissatisfaction.

A reliable network keeps ATMs operational at all times. Customers expect access to their funds 24/7. Any downtime can harm your reputation.

Consider an area prone to power outages. A processor with backup systems will keep ATMs running smoothly. Customer satisfaction relies on consistent service.

Infrastructure Evaluation

Check the processor’s infrastructure for handling peak volumes. During holidays or weekends, transaction numbers spike. The system should handle these without delays or failures.

Look for processors that offer load balancing and redundancy features. These ensure smooth operations even during high demand periods.

e processors have data centers in multiple locations. This spreads out the load and prevents bottlenecks. Evaluate if they provide real-time monitoring and alerts for any issues atm.

Maximizing Earnings

Fee Structure

Analyzing the fee structure of an ATM processor is crucial. Each transaction typically incurs a fee. This fee can vary greatly between processors. Lower fees mean higher earnings for you.

Payment splitting options also matter. Some processors offer flexible payment plans. They might split earnings in different ways, like per transaction, monthly, or at the ATM.

Additional Services

Many ATM processors offer extra services to boost income. Advertising on ATMs is one such service. You can display ads on the ATM screen while users wait for their cash.

Loyalty programs are another option. Users earn points each time they use your ATM. These points can be redeemed later, encouraging repeat usage.

Cash Management

Consider the processor’s policies on ATM vaulting and cash management. Efficient cash management reduces operational costs. Some processors offer automated vaulting services.

Automated vaulting means less manual handling of money. It ensures that your ATMs are always stocked with cash, reducing downtime.

Operational Costs

Reducing operational costs enhances profitability. Look at the support services provided by the processor. Good customer service can save time and money.

e processors offer 24/7 technical support. This helps resolve issues quickly, minimizing downtime and lost revenue atm.

Evaluating Fees and Contracts

Hidden Fees

Hidden fees can significantly impact your profits. Scrutinize the processor’s fee schedule carefully. Look for charges that are not immediately obvious. Some processors may include fees for services you rarely use, such as ATM. These could add up over time and reduce your earnings at the ATM.

Ask about all possible fees upfront. Monthly maintenance fees, statement fees, atm, and customer service charges are common examples. Ensure you understand every fee listed in the contract before signing.

Surcharge Fee

The surcharge fee is another critical factor to consider. This fee is what customers pay when they use your ATM. It directly affects how much you can earn from each ATM transaction.

Compare different processors’ surcharge fees. Higher surcharge fees can mean more profit per transaction. However, if the fee is too high, it might deter customers from using your ATM.

Transactions

Transaction volume plays a crucial role in choosing an ATM processor. Your business size and the number of transactions you process monthly at the atm should influence your decision.

Negotiate with potential processors based on your transaction volume. Larger businesses often have leverage to secure lower rates or better terms due to their higher transaction numbers.

Contract Lengths

Long-term contracts can lock you into unfavorable terms. Compare contract lengths carefully before making a decision.

Look for contracts that offer flexibility. Shorter contracts or month-to-month agreements provide more freedom if you’re unhappy with the service.

Termination Clauses

Termination clauses are another essential aspect of contracts to review closely. Some processors charge hefty termination fees if you end the contract early.

Ensure you understand these clauses fully before committing to a contract atm. Try negotiating for lower termination fees or more favorable terms if needed.

Essential ATM Processor Services

ATM Vaulting

ATM vaulting is crucial for security. It involves storing and managing cash reserves for ATMs. A good processor should offer reliable vaulting services. This ensures that your ATMs always have enough cash. It also reduces the risk of theft.

Using a processor with strong vaulting services and atm can save you time and stress. They handle the logistics of cash delivery and storage. This allows you to focus on other aspects of your business atm.

Payment Automation

Payment automation simplifies transactions. It makes the process faster and more efficient. Look for processors that offer advanced payment automation features.

These features can include:

- Real-time transaction processing

- Automated settlement processes

- Fraud detection systems

Automated systems reduce human error and increase transaction speed. This leads to a better experience for your customers.

Service Agreement Templates

Service agreement templates are essential for clear communication. They outline the terms and conditions between you and the processor. A good processor will provide customizable templates.

These templates help ensure both parties understand their responsibilities. They cover important details like fees, maintenance schedules, atm, and service levels.

Having clear agreements prevents misunderstandings. It also helps in resolving disputes quickly.

Customizable Service Packages

Customizable service packages allow you to tailor services to your needs. Not all ATM operations are the same, so flexibility is key.

Check if the processor offers different packages or add-on options. This can include:

- Different levels of technical support

- Various types of reporting tools

- Optional security features

Being able to customize ensures you get exactly what you need without paying for unnecessary services.

Commitment to Innovation

Innovation keeps your business competitive. Choose a processor that invests in new technologies and industry trends atm.

Processors committed to innovation will offer updates regularly. They stay ahead of industry changes and improve their services over time atm.

This commitment can include:

- Upgrading software systems

- Implementing new security measures

- Adapting to regulatory changes

A forward-thinking processor helps your business grow by providing cutting-edge solutions atm.

Flexibility and Final Decision

Business Adaptation

Evaluate how well the ATM processor can adapt to your business changes. Look for processors that offer flexible services. They should be able to handle different transaction types, atm, and scales. If your business grows, the processor must scale its services accordingly.

Check if they provide custom solutions tailored to your needs. This flexibility ensures that you won’t outgrow their capabilities.

Reputation Check

Consider the processor’s reputation in the industry. Research customer feedback and reviews online. Positive reviews often indicate reliable service. Negative feedback can highlight potential issues.

Look into their industry standing as well. A processor with a strong reputation is more likely to provide consistent and high-quality service.

Customer Feedback

Gather insights from other businesses using the same processor. Ask about their experiences with communication and support. Good customer service is crucial for resolving issues quickly.

Talk to clients who have been with them for a long time. Their feedback can reveal how well the processor maintains relationships over time atm.

Strategic Partnership

Reflect on the long-term potential of partnering with this ATM processor. Consider if they align with your business goals and values atm. A good strategic partner will grow alongside your business.

Ensure they offer ongoing support and updates to stay current with technology trends atm. This helps in maintaining an efficient operation in the long run atm.

Mutual Growth

Think about mutual growth opportunities with the processor. They should be invested in helping your business succeed. Look for processors that offer training or resources for better utilization of their services.

A partnership where both parties benefit leads to sustainable success and innovation over time.

Summary

Choosing the best ATM processor can feel like navigating a maze, but you’ve got this. By understanding the essentials, from equipment to fees, you’re well on your way to making a smart decision. Remember, it’s all about finding a balance that maximizes your earnings and provides quality support atm.

Now it’s time to take action. Dive into the details, ask questions, and don’t settle for less than what you deserve. Your business depends on it. Ready to make that choice? Let’s get started!

Frequently Asked Questions

What should I look for in an ATM processor?

Look for reliability, good support, and low fees. Think of it like choosing a car: you want something dependable atm that won’t cost a fortune to maintain.

How important is banking network availability?

Very important! It’s like having a GPS with no signal. Your ATM needs access to multiple networks to serve more customers efficiently.

Why is quality support crucial?

Imagine your ATM breaks down and there’s no one to fix it. Quality support ensures quick fixes, minimizing downtime and keeping your earnings flowing atm.

How can I maximize my earnings with an ATM processor?

Choose processors offering competitive rates and revenue-sharing models. It’s like finding the best deal on your favorite snack atm – more value for less money.

What should I know about fees and contracts?

Read the fine print! Hidden fees can sneak up on you like unexpected traffic tickets or atm charges. Ensure transparency and fair terms before signing anything.

Are essential services from an ATM processor really necessary?

Absolutely! Essential services are like the engine of your car – without them, nothing runs smoothly. They ensure transactions are processed securely and efficiently.

How does flexibility impact my final decision?

Flexibility is key! It’s like choosing a pair of jeans – they need to fit well now but also adapt as you grow atm. Ensure your processor can scale with your business needs.