Choosing the right ATM Testing Software, technologies, and virtual ATMs can feel like navigating a maze. With so many options out there, it’s easy to get lost in the details of research, marketing, technologies, and cloud. But don’t worry—I’ve got your back. This guide will break down the essential tips for selecting the right ATM software, including virtual ATMs, monitoring, and management, making the process a breeze.

We’ll cover everything from security features to user experience in our business management suite, ensuring you make an informed decision. Whether you’re upgrading your current system or starting from scratch, these tips will help you find management software that fits your business needs perfectly. Stick around and let’s dive into what makes great ATM software tick for business management.

Key Takeaways

- Assess Needs First: Identify your specific requirements to ensure the ATM software aligns with your business goals.

- Prioritize Reliability: Choose software with a proven track record for reliability and minimal downtime.

- Watch Transaction Fees: Understand the fee structure of atm software to avoid unexpected costs that can eat into profits.

- Support Matters: Opt for software that offers robust support and maintenance to handle any issues promptly.

- Plan Setup Thoroughly: Prepare for the ATM setup process by coordinating with providers and ensuring all logistics are covered.

- Stay Updated on Trends: Keep an eye on emerging Stay Updated on ATM technology trends to stay competitive and meet customer expectations.

Assessing Your Needs

Banking Tasks

Identify the range of banking tasks your customers expect from ATMs. Modern ATMs offer more than just cash withdrawals. They can handle deposits, bill payments, and cardless access. These features cater to a wide variety of customer needs, including ATM software.

For instance, many clients prefer depositing checks directly at an ATM instead of visiting a bank branch. This saves time and provides convenience. Bill payments through ATMs also help customers manage their finances efficiently.

Cardless access is another feature gaining popularity. It allows users to withdraw money using their smartphones without needing a physical card through atm software.

Proximity Importance

ATM proximity is crucial for younger generations. They value quick and easy access to banking services. Millennials and Gen Z often look for ATMs near their homes or workplaces.

When planning network expansion, consider placing ATMs in high-traffic areas like malls or transit stations. This ensures that your services, including atm software, are always within reach for these tech-savvy users.

Proximity not only improves convenience but also builds trust with your clients. Knowing they can quickly access an ATM boosts their confidence in your banking services.

Personalized Offers

Evaluate the need for personalized banking offers through ATMs. Personalization enhances customer experience by providing tailored options based on individual preferences.

For example, some banks use data analytics to offer custom loan products or investment advice at ATMs. This makes the interaction more relevant and engaging for the user of atm software.

Personalized offers can include special promotions or discounts on financial products through ATM software. These incentives encourage customers to use your Transacto ATM services more frequently.

Choosing Reliable Software

Proven Track Record

Select software with a proven track record. CR2’s BankWorld ATM is an example. It has shown reliability and innovation over the years. Companies like these invest in cutting-edge technology.

Wide Array of Services

Ensure the software supports various services. Look for client, switch, and card management systems. These features help in seamless operations. They also cater to different customer needs.

Customization Options

Prioritize software that offers customization. ATM Design Studios offering ATM testing services provide tailored customer interactions. This makes the user experience unique. Personalization can increase customer satisfaction.

Security Features

Security is crucial for ATM software. Choose solutions with robust security measures. Encryption and fraud detection are vital components. These features protect both the bank and its customers.

User-Friendly Interface

A user-friendly interface is essential. It should be easy to navigate for both staff and customers using atm software. Simple interfaces reduce training time and errors. Ensure the design is intuitive.

Support and Maintenance

Good support and maintenance are important. The company should offer regular updates and troubleshooting help. This ensures the software remains up-to-date and functional.

Understanding Transaction Fees

Fee Structure

ATM software solutions offer various fee structures come with different fee structures. Some charge a flat fee per transaction, while others use a percentage-based model in ATM software. Flat fees provide predictability in costs. However, percentage-based fees can be more suitable for high-value transactions.

Consider how these fees will impact your revenue. For example, if you operate an ATM in a busy area, flat fees might save money over time. Conversely, percentage-based fees could reduce profits on larger transactions.

Vendor Comparison

Comparing transaction fees across vendors is crucial. Each vendor offers unique pricing models and features. Look at the total cost of ownership, including hidden charges like maintenance or upgrade fees.

e vendors might offer lower transaction fees but charge higher monthly service costs. Others might include additional features that justify their higher fees. Always weigh the pros and cons before making a decision.

Long-term Implications

Transaction fees have long-term financial implications on your ATM operations. High fees can eat into your profits over time. They can also affect customer satisfaction if passed on to users.

Customers may avoid ATMs with higher usage fees, leading to reduced traffic and revenue. Evaluate both immediate and future impacts of these fees on your business model.

Considering Support and Maintenance

Technical Support

Evaluate the level of technical support provided by ATM software vendors. Effective support services are crucial for smooth operations. Check if the vendor offers multiple channels for assistance, such as phone, email, and chat. Ensure that their team is knowledgeable and can handle various issues promptly.

24/7 support availability is essential. ATMs operate around the clock, so downtime must be minimized. Quick resolution of problems helps maintain customer trust and satisfaction. Vendors should guarantee a fast response time to address any system failures or glitches.

Regular Updates

Determine the vendor’s capacity for regular software updates. Frequent updates ensure that your ATM network remains secure against emerging threats. Security patches are vital to protect sensitive customer data from cyberattacks.

Updates also often include new functionalities and improvements. These enhancements can improve customer experience and streamline operations. A vendor committed to regular updates shows dedication to keeping their system current.

Maintenance Services

Assess the maintenance services offered by the vendor. Routine maintenance helps prevent unexpected issues and prolongs the lifespan of your ATMs. Vendors should provide detailed maintenance schedules and procedures.

Maintenance services may include hardware checks, software diagnostics, and cash management systems reviews. This comprehensive approach ensures all aspects of your ATM suite are functioning optimally.

Cost Considerations

Consider the cost of support and maintenance services when selecting ATM software. While initial costs might seem high, investing in good support can save money in the long run by avoiding expensive repairs or replacements.

Compare different vendors to find one that offers value for money without compromising on quality. Look for transparent pricing models that outline what is included in their support packages.

Customer Feedback

Research customer feedback on various vendors’ support services. Reviews from other businesses can provide insights into how well a vendor performs in real-world scenarios.

Look for feedback on response times, issue resolution effectiveness, and overall satisfaction with maintenance services. Positive reviews indicate reliable service, while negative ones might signal potential problems.

Preparing for ATM Setup

Integration Plan

Integrating ATM software with existing banking systems is crucial. This ensures seamless operations and customer satisfaction. Banks must check the compatibility of their current systems with the new software. They should also plan for data migration and system updates.

A well-thought-out integration plan can prevent disruptions. Banks often conduct pilot tests before full deployment. These tests help identify potential issues and fix them early.

Hardware Compatibility

Assessing hardware compatibility is essential when selecting ATM software. Not all software works with all types of ATMs. Banks need to ensure that their chosen software matches their hardware specifications.

Reviewing the technical requirements can save time and money. For example, some older ATMs may need upgrades to support new software features. Ensuring hardware compatibility helps avoid setup issues and operational delays.

Logistical Aspects

Considering logistical aspects is another key step in preparing for ATM setup. Site selection plays a significant role in the success of an ATM deployment. Banks often choose high-traffic areas to maximize usage.

Installation support from vendors is also important. Vendors usually offer services like site assessment, installation, and initial testing. This support can streamline the deployment process and ensure everything runs smoothly from day one.

Evaluating ATM Providers

Track Record

Check the history of Cashless ATM software providers. Look at their reputation. Read customer feedback. Seek out case studies. These can offer insight into real-world performance.

A provider with positive reviews is often reliable. Negative feedback can highlight potential issues. Case studies show how the software performs in different scenarios.

Comprehensive Tools

Compare tools and features from various vendors. Euronet’s Ren ATM Management tools and features offers a suite of tools for monitoring and managing ATMs. It includes security features and transaction processing.

KAL’s Kalignite provides similar tools but with a focus on flexibility and customization. It supports multiple hardware types, which can be useful for diverse ATM networks.

Scalability

Consider if the software can grow with your needs. A scalable solution supports future expansion. As your network grows, you need software that can handle more ATMs without slowing down.

Scalable solutions also allow for adding new features over time. This ensures your ATMs stay current with technological advances.

Trends in ATM Technology

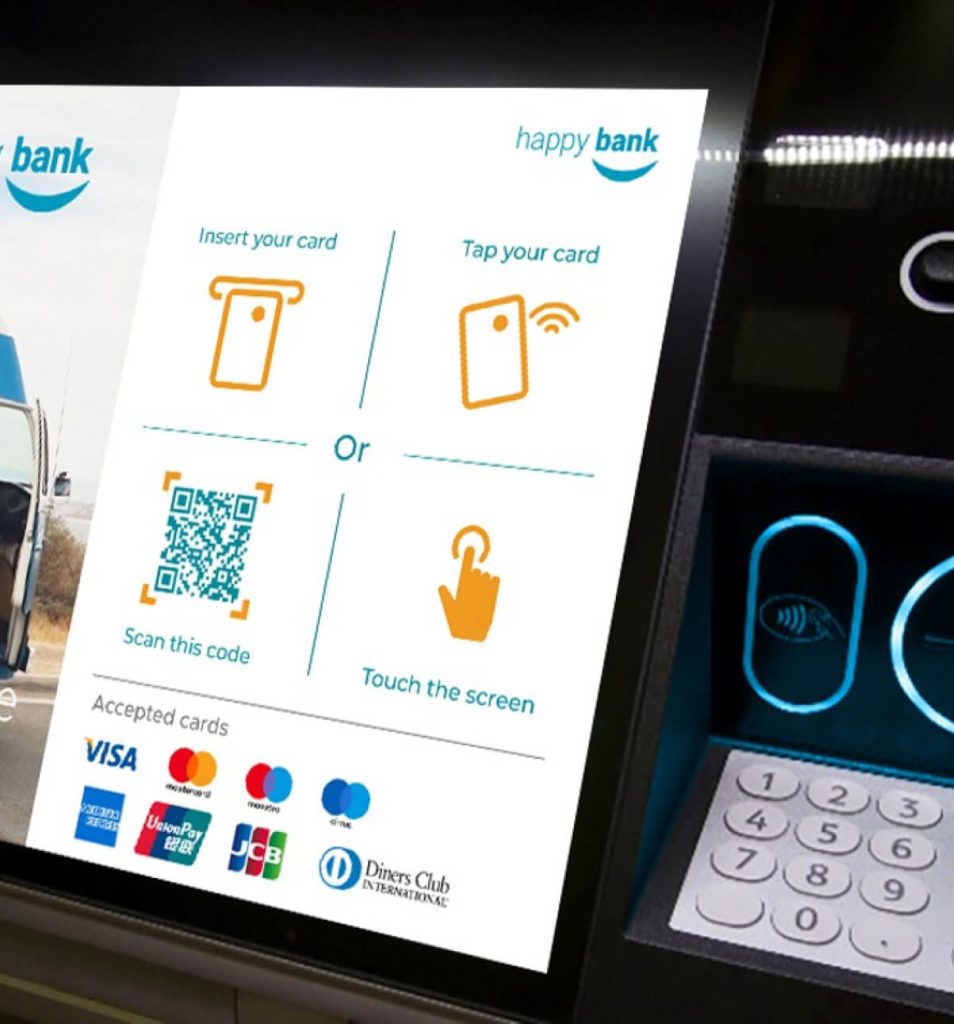

Contactless Transactions

Contactless transactions are gaining popularity. They allow users to make payments without inserting their cards. This technology uses NFC (Near Field Communication). It makes transactions faster and more secure. Many banks now offer contactless ATMs.

Mobile Banking Integration

Mobile banking integration is another trend. Users can link their bank accounts with mobile apps. This allows them to manage finances on the go. Some ATMs even let you withdraw cash using a mobile app instead of a card. This feature enhances convenience for customers.

Enhanced Security Features

Security is crucial for ATMs. Dynamic currency conversion is one security feature that helps. It converts foreign currency at the point of transaction, reducing fraud risks. Interactive teller machines (ITMs) also improve security by allowing remote assistance from live tellers.

AI and Machine Learning

AI and machine learning are transforming ATM operations. These technologies can predict maintenance needs before issues arise, ensuring less downtime. They can also personalize customer experiences, offering tailored services based on user behavior.

Predictive Maintenance

Predictive maintenance uses AI to monitor ATM components in real-time. It helps identify potential failures early, preventing breakdowns. Banks can schedule repairs proactively, ensuring ATMs remain operational.

Personalized Customer Experiences

Personalized experiences are becoming common in ATMs. By analyzing transaction data, AI can suggest relevant services to customers. For example, it might recommend loan offers or investment options based on spending patterns.

Future of ATM Services

Virtual ATMs

Virtual ATMs are becoming more common. These machines do not require physical cards. Users can access services through their smartphones. This reduces the need for plastic cards.

Banks are investing in this technology to meet user expectations. People want faster and more secure transactions. Virtual ATMs offer both. They also provide a seamless experience with digital banking platforms.

Contactless Transactions

Contactless transactions are on the rise. Many users prefer them for their speed and convenience. Customers can use NFC-enabled devices to complete transactions without touching the ATM.

This method is safer, especially during health crises like COVID-19. It also speeds up the process, making it more efficient for users and banks alike.

Cardless Access

Cardless access is another emerging trend. Users can withdraw cash using a smartphone app or QR code. This eliminates the need for carrying a card.

Banks benefit from this as well. It reduces the risk of card fraud and skimming attacks. Cardless access also aligns with the growing preference for mobile banking solutions.

Role in Banking Ecosystem

ATMs play a strategic role in modern banking. As physical branches become less common, ATMs fill the gap by offering essential services.

They serve as mini-branches, providing:

- Cash withdrawals

- Deposits

- Account inquiries

- Bill payments

ATMs enhance customer reach, especially in remote areas where branches are scarce.

Integration with Digital Banking

Integration with digital banking platforms is crucial for future ATMs. Customers expect a unified experience across all channels—online, mobile, and ATM.

This integration allows users to:

- Check account balances

- Transfer funds

- Pay bills

- Access personalized offers

Final Remarks

You’ve got all the tools now to pick the best ATM software for your needs. From assessing your requirements to understanding transaction fees and evaluating providers, you’re well-equipped to make a smart choice. Remember, the right software can make or break your ATM service.

Don’t wait—take action today! Dive into the latest trends and prepare for the future of ATM services. Your customers will thank you, and you’ll stay ahead of the game. Ready to get started? Let’s make it happen!

Frequently Asked Questions

How do I assess my ATM software needs?

Start by identifying your transaction volume and types. Consider features like user interface, security, and compliance. Think of it as tailoring a suit; it must fit your specific requirements perfectly.

What makes ATM software reliable?

Reliable software should have a proven track record, robust security measures, and regular updates. It’s like choosing a car—you want one that’s dependable and safe.

Why are transaction fees important when selecting ATM software?

Transaction fees can add up quickly. Compare different software options to find the most cost-effective solution. It’s like shopping for groceries; you want quality without breaking the bank.

How crucial is support and maintenance for ATM software?

Very crucial! Good support ensures quick issue resolution, while regular maintenance keeps your system running smoothly. Think of it as having a good mechanic for your car—essential for long-term reliability.

What should I consider when preparing for ATM setup?

Plan for location, hardware compatibility, and network requirements. It’s like setting up a new home; every detail matters to make it functional and efficient.

How do I evaluate different ATM providers?

Look at their reputation, customer reviews, and service offerings. It’s similar to reading restaurant reviews before dining out—you want the best experience possible.

What are the latest trends in ATM technology?

Keep an eye on advancements like contactless transactions and enhanced security features. Staying updated is like keeping your wardrobe current with fashion trends—it keeps you relevant and competitive.